-

BackWhat we doNumis is an ambitious, dynamic and innovative investment bank, driven to excel across all aspects of its delivery.Investment Banking

-

BackLatest newsRead the latest news about our business, our people and our work, find out about our next events and conferences.News

-

BackWho we areOur collaborative environment and distinctive way of excelling , is nothing without our great people.

-

BackOur board

Debt Advisory Update

Happy belated International Women’s Day! Officially adopted in 1975 by the UN -a virtuous opportunity to reflect upon and honour women’s achievements.

At Numis last week, I was delighted to help organise our first “Inclusive Numis Network” event with an incredible host of panellists to discuss “Diversity in the Workplace” in honour of the upcoming International Women’s Day – but for now I will return my time & efforts to the debt market!

TL/DR: ESG deals and documents; Wars and funding; Tesla and strike prices

1. Environmental deal flows into the market

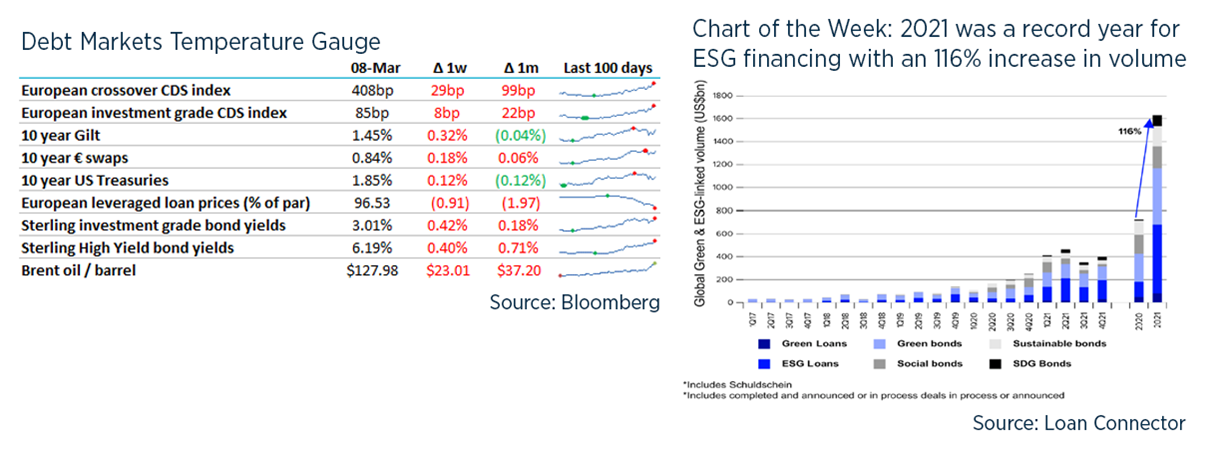

- Not everyone likes ESG but the market says otherwise as the first GBP bond, since the Ukraine conflict began, went flying off the shelves at 4.7x covered last week.

- Bazalgette Finance plc’s 12-year £300m green bond to fund the Thames Tideway tunnel pulled in positive demand, pricing at G+130bp, which was 15-20bp inside initial price talk.

- Bazalgette (not a first time issuer) is aptly named after Sir Joseph William Bazalgette who was a civil engineer in the 19th century and who built London’s first sewer network (still in use today) which ultimately wiped out cholera and “the great stink” – his great-great-grandson Peter Bazalgette is responsible for shows such as Big Brother, which probably had the opposite effect.

- The bond follows with the issuers Sustainable Finance Framework which is aligned with the ICMA Green Bond Principles.

- The only other deal in the GBP market last week was also green - Blend Funding plc, a financial aggregator, also raised £107m of social bonds as part of their ongoing EMTN programme to lend to registered housing associations throughout the UK.

- Rather timely, to help clarify the difference between green v social v sustainability, the LMA (Loan Market Association), APAC LMA and Loan Syndications & Trading Association recently published two new ESG guides too – Guidance on Social Loan Principles and Guidance for Green, Social and Sustainability-Linked Loans External Reviews.

- The titles are almost as long as the whole documents, which are only 5 & 7 pages long respectively and worth a read to gain better clarity on the requirements for green, social and sustainability-linked loans.

2. Social support for soldiers

- Last week the Ukraine’s Ministry of Finance issued eq-$277m “war bonds” to help fund its armed forces – the final coupon was at 11%.

- War bonds are not a new concept: their origins date back to the Funding Act of 1790 or “Debt Assumption” where Hamilton proposed the federal Treasury raise bonds that rich people could buy to cover the costs of the American Revolution which totalled $25m.

- Despite Ukrainian government bonds down to 30 cents on the dollar, the war bonds were oversubscribed by local investors and the country also paid out $300m of bond interest to international investors.

- Meanwhile the financial conditions for Russia continue to worsen – sovereign bonds are down to 8 cents on the dollar, the rouble declined by more than 40% last week to a record low and interest rates were pushed from 9 to 20% to try offset the impact for savers.

- Russian instruments have also been removed from MSCI, S&P Dow Jones and FTSE Russell indices and following JP Morgan’s survey they too will be removing Russian debt from their “widely used bond indexes” – but that hasn’t stopped some investors taking a “golden opportunity that will never happen again” on Polymetal International and Evraz plc.

3. Musk be a Governance issue

- Last week, Elon Musk donated Starlink antennas to the Ukraine to ensure they can maintain vital internet access and keep the local cats warm.

- He was also in the news as he is countersuing JP Morgan for “bad faith and avarice” and being “entirely self-serving” after they filed to require him to pay $162.2m (plus interest and fees).

- It all stems back to $1.6 billion of Tesla’s convertible notes put in place in 2014 to fund the development of its “Gen III” vehicle.

- Following an infamous tweet made by Musk in 2018, stating “Am considering taking Tesla private at $420. Funding secured”, Musk resigned as chairman and he and Tesla were subsequentially fined $20m each by the SEC.

- The tweet also triggered an “Extraordinary Event”, which led to JP Morgan (official calculation agent) readjusting the strike price on their derivatives from $560.6388 to $424.66 “to maintain the same fair market value as the warrants had before Tesla’s announcement” based on the average implied volatility.

- When it was announced that Musk was abandoning the deal, the strike price was then readjusted again to $484.35 on the same rationale. However, when the trade expired in 2021, Tesla declined to pay out.

- JP Morgan believes it can be decided on “admitted facts and long-established contract laws” alone, whereas Musk alleges the bank made an “act of retaliation” for not being included in the profitable underwriting agreements that could’ve ensued.

- In the words of Leonard Cohen (or now Blackstone & Hipgnosis) “hey - that’s no way to say goodbye!” but I don’t think this will be the end of it anytime soon…

Recent (and few) UK Financings

- GXO is funding its £965m offer for Clipper Logistics with a £745m bridge arranged by Barclays and Citi.

- IWG has signed a £330m bridge loan underwritten by HSBC and Barclays to back its merger with The Instant Group.

- Biffa issued £195m of sustainability-linked private placement debt with 3 investors, including Pricoa.

- Trafigura has agreed a nine-month $1.2bn RCF to be syndicated by Mizuho, Soc Gen, Sumitomo and UniCredit to “safely navigate the unprecedented market conditions”.

- Harland & Wolff has signed a $35m green term loan (with a $35m accordion) to fund working capital for the fabrication of wind turbine generator jackets.

- Bazalgette raised a 12-year £300m Green secured bond offering to fund Thames Tideway

- Still waiting for the morning Bloomberg email to say something other than “No Meetings Scheduled” but until then Morrisons, Unilever, Intertrust, Accell and Uvesco will have to wait.

Our services

Numis is an ambitious, dynamic and innovative investment bank, driven to excel across all aspects of its delivery.