-

BackWhat we doNumis is an ambitious, dynamic and innovative investment bank, driven to excel across all aspects of its delivery.Investment Banking

-

BackLatest newsRead the latest news about our business, our people and our work, find out about our next events and conferences.News

-

BackWho we areOur collaborative environment and distinctive way of excelling , is nothing without our great people.

-

BackOur board

Debt Advisory Update

At this time of year, I’m reminded of my first Christmas job which was 12-hour shifts gutting turkeys for £2/hr. Wrestling with loan documents or Excel is a doddle by comparison.

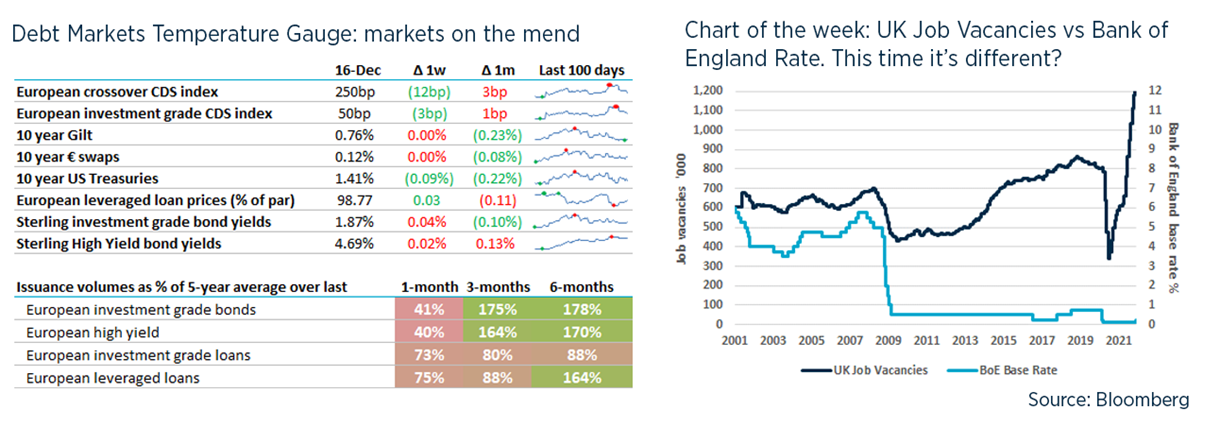

Today the Bank of England surprised the markets by a 15bp rise in interest rates, to 0.25% - so still really low by historical standards and maybe not enough to counter inflation coming from input costs and a tight labour market.

Good luck avoiding Covid / revising your plans to cope with infection in the family / French resistance to UK travellers. Happy Christmas.

TL / DR: 2021 Biggests, Evergrande reinvents restructuring, SoftBank

1. 2021: A year of Biggests and Firsts

- In the wise words of Sir Archibald Kerr, “in these dark days man tends to look for little shafts of light that spill from Heaven” and we should celebrate some of the Firsts / Biggests that we saw in 2021.

- Biggest ever Sterling High Yield: in February, Barclays sold £2.75bn of high yield bonds on behalf of TDR / Issa / Asda, which included a single tranche of £2.25bn of secured notes – the biggest ever sterling high yield bond. This was sold at par, peaked at just under 102 after a week and has been on a downward trajectory since then, hitting 94.5 a couple of weeks ago. You could interpret this as TDR taking £135m of value from the bondholders …

- Biggest ever Sterling Unitranche: in November, UK wealth manager FNZ lined up £1.5bn in unitranche debt with HPS, Arcmont, GS and HayFin.

- Biggest ever Sterling private placement bond: Viridor priced a £1.6bn private placement bond to refinance KKR’s acquisition earlier this year, for 22 years at 2.90%.

- Global High Yield market hit its biggest ever size: there is now just under $400bn of HY outstanding in Europe and $1.4tn in the US – together up over 30% since January 2020.

- First criminal prosecution by the FCA of a UK bank under its anti-money laundering laws (some irony that it happened to be the one bank that the UK Government still controls).

- UK job vacancies reached 1.2m in November – a record high.

- Biggest win for England’s women’s football team: 20-0 vs Latvia in December.

- First time that Vinyl record sales exceeded CDs since 1987.

- And one for the Australians: First England First Ball Ashes Duck since 1936 – if it helps Rory Burns feel better, the last man to do this ended up teaching Sunil Gavaskar to bat.

2. Evergrande – biggest corporate restructuring ever?

- Fitch kicked off what could be the world’s biggest restructuring by declaring Evergrande to be in Restricted Default – so far this affects $20bn of international bonds out of maybe $300bn of total liabilities.

- Evergrande itself is still being coy about acknowledging its default but that’s because normal business rules no longer apply: its board has been taken over by the Chinese state.

- Beijing has decreed that this situation will be handed in a “market-oriented way” i.e. no government bail-out. Overseas bondholders will scrabble around for whatever scraps are left after domestic creditors have been addressed.

- This isn’t enough to put off some fearless distressed debt investors which have recently bought $200m of Evergrande’s bonds at 20c / $ - good luck to them!

- The new management of Evergrande apparently intends to prefer to pay homebuyers waiting for their apartments or some of China’s 52 million migrant construction workers needing to be paid so they can return home for Chinese New Year – to head off social unrest.

- I don’t think foreign investors are going to have much success here and they will be completely frozen out of the restructuring process – indeed, offshore bondholders of another defaulting Chinese developer Kaisa are resorting to buying more onshore debt, just so that they can get in the loop on information flows.

- As a reminder about how long they might have to wait to be paid, there is $1.6tn of pre-revolutionary Chinese debt that remains unpaid and repudiated by China – even Trump couldn’t find a way to leverage this.

- A while ago, I described some of the ways in which debt can be senior or subordinated – security, structure etc.; I should have also included respecting the wishes of the Chinese government.

3. SoftBank: WeDidn’tWork

- I was talking to a friend this week who worked for Majestic Wine and I was reminded that Fortress Investment Group acquired this in 2019. Fortress focuses on “asset backed” situations and for some reason Majestic fulfilled this. I can more easily understand why it was interested in Morrison’s £8bn property portfolio.

- Incidentally, CD&R’s bank group did postpone the Morrison’s acquisition financing into 2022 – apparently hoping that good trading over Xmas will offset the 0.75%pt hike in Asda’s yields in recent months.

- It’s not very clear to me why SoftBank bought Fortress Investment Group in 2017, given that its focus is on technology and Fortress loves old assets – this week it bought Punch Taverns and its 1,300 UK pubs for £1bn.

- One explanation is that Fortress provided some structure to SoftBank’s investment process but it may also been driven by Rajeev Mistra who moved from Fortress to run SoftBank’s Vision Fund.

- My favourite SoftBank publication is its presentation to investors in late 2019 with its Hypothetical Illustration of EBITDA that just … goes up because of “improvements”.

- If your appetite for SoftBank slides is whetted then I suggest you check out this selection which includes the mission statement “SoftBank works to comfort people in their sorrow”.

- I was reminded of all this because last week SoftBank sold some of its debt that it had provided to WeWork as part of its rescue package after its planned IPO imploded in 2019. In line with the rest of 2021’s craziness, WeWork has now gone public via a SPAC, albeit only for $9bn not the $47bn it was aiming for in 2019 and SoftBank still owns >50%. According to its SPAC presentation, in 2020, WeWork lost $2bn in EBITDA on revenue of $3.2bn, which is an impressive rate of cash burn.

- SoftBank sold $550m of its debt it had lent to WeWork at a discounted price of 86c / $ to yield just under 10%. This came as a shock to WeWork’s other bondholders who had previously thought a yield of 8% was appropriate. A price in the mid 80s is normally seen as a sign of credit weakness but not for SoftBank which described this as “a sign of confidence in WeWork”. I would not want my creditors to have such “confidence” in me.

- Finally, we shouldn’t forget how WeWork sold its bonds in 2018 using “Community Adjusted EBITDA”, which with hindsight seems much more sensible than 2021’s roller-coaster rides of GameStop or AMC.

Recent UK Financings

Loans & PPs

- Frasers (nee Sports Direct) signed a £930m term loan and RCF for 3+1+1 maturity.

- Redde Northgate signed £475m 4-year RCF (down from £603m) and €375m of private placement bonds of 6-10 maturities. RCF was 2% and the PPs cost 1.1-1.5% (about €mid-swaps + 120bp).

- Home REIT signed £130m loan with Scottish Widows at 2.53%.

- Iomart signed 4-year £100m RCF at SONIA +180bp with HSBC, NatWest, Bank of Ireland and Clydesdale.

- Dunelm signed a 4-year loan, linked to ESG targets, including a commitment to net zero.

- The private housebuilder Hill signed a new £220m sustainability-linked RCF with Lloyds, NatWest, HSBC and Santander.

- Clinigen’s buyout by Triton was backed by £610m of senior secured debt at E+450bp and SONIA + 550bp and a £140m second lien loan paying E+775bp. Barclays, JPM, Credit Suisse and HSBC are underwriting this.

- Rentokil signed a $2.7bn bridge for its acquisition of Terminix, underwritten entirely by Barclays (well-played all those in 5NC!).

- M&S signed at £850m sustainability-linked RCF measured against its pathway to achieving net zero Scope 3 (by 2040!).

- Intertek is reported to have priced $400m of 5-9 year private placement where several investors bid to own the whole amount. Pricing was rumoured to be T+ low 100s bp.

- Scottish Mortgage placed another $200m 30 and 40 year private placement with 5 investors.

Bonds

- Shell priced $1.5bn across 20-30 years at T+95 and T+105bp.

Disclaimer

This briefing has been prepared using publicly available information and should not be relied upon for any investment decision. Numis does not make any representation or warranty, either express or implied, as to the accuracy, completeness or reliability of the information contained in this briefing. Numis, its affiliates, directors, employees and/or agents expressly disclaim any and all liability relating to or resulting from the use of all or any part of this briefing or any of the information contained herein. This briefing does not purport to be all-inclusive or to contain all of the information that recipients may require. The information contained herein is subject to change and Numis accepts no responsibility for updating it.

Our services

Numis is an ambitious, dynamic and innovative investment bank, driven to excel across all aspects of its delivery.