-

BackWhat we doNumis is an ambitious, dynamic and innovative investment bank, driven to excel across all aspects of its delivery.Investment Banking

-

BackLatest newsRead the latest news about our business, our people and our work, find out about our next events and conferences.News

-

BackWho we areOur collaborative environment and distinctive way of excelling , is nothing without our great people.

-

BackOur board

Debt Advisory Update

It’s been a week of anniversaries, beginning with the sombre milestone of 20 years since 9/11. It feels like yesterday that we watched in shock as it unfolded, first in the office then after we quickly left work with my housemates back home. I didn’t realise at the time how much it would change the world – not least the reality of globalism: there is no longer an “over there” and an “over here”.

Wednesday was the 13th anniversary of the collapse of Lehman, demonstrating vividly Hemmingway’s description of how bankruptcy happens “gradually then suddenly”. I came across this article by S&P from 12 Sep 2008, headlined “Lehman not expected to fail, S&P analyst says” …

Finally, I was saddened to learn that Sir Clive Sinclair died yesterday. Many of you over 45 will have had a ZX Spectrum and a much smaller number might have coveted a Sinclair C5 in 1985 – let me know if you actually owned or drove one. The BBC notes that he was “a devoted father and grandfather”, though perhaps not the best husband.

TL / DR: The cost of being un-ESG; Change of Control protection; Logos

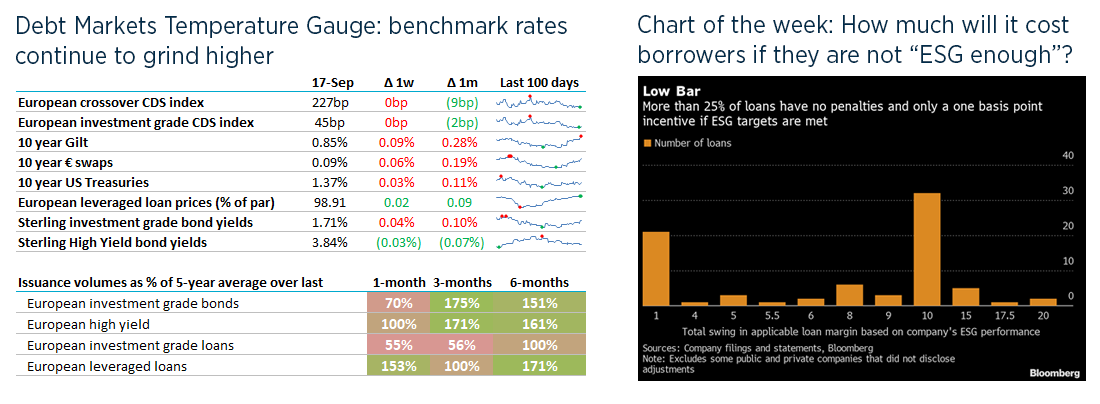

1. The cost of being un-ESG

- Many ESG loans that we’ve seen with an ESG link have +/- 5bp (0.05%) in interest costs depending on performance against ESG targets. Some ESG-linked bonds have a bigger incentive, up to 1% if targets are not met and leveraged loans often have 10-20bp steps.

- Why is this delta so low? Well, It takes two to tango:

- For banks, corporate loans are often a loss-leading ticket to wider business – so it’s not appealing to put them further underwater by offering a large ESG discount.

- CFOs are often unwilling to risk significant shareholder value in the event they fail to hit ESG targets.

- 5bp is plausible as the smallest possible “large number”, but one which will actually make limited difference to lender or borrower whatever happens.

- In passing, I note that one of the ESG obligations for Virgin Media Ireland when it issued an ESG loan this summer was simply to have an ESG framework within a year.

- If a loan becomes more profitable for a lender if ESG targets are not met then this creates some ‘interesting’ incentives for the bank – as with Cliff Asness’s argument that if ESG investing is designed to raise the cost of capital for ‘bad’ businesses then it also raises returns for investors who are happy to invest in ‘bad’ businesses – a bit like the old “sin stock” investors who did well out of tobacco 10-20 years ago.

- Matt Levine had two articles on this last week, to which I can’t add much – just subscribe to his free newsletter.

- The idea that ESG-linked loans contain an embedded derivative raises the prospect of having to create a Mark To Market value – more work for accountants, who are also aiming to win from expanding their ESG consulting arms, as reported in the FT.

- In other news, the UK’s first green gilt is being syndicated next week. I’m not sure how this will lead to the government becoming “more green” – maybe it should try instead to improve its Governance.

2. Change of control

- We’ve had a few discussions this week on Change of Control clauses in debt, typically enabling lenders to be repaid if they don’t like a new owner.

- A long time ago, bonds didn’t have any protection, leading to situations like the Goldman Sachs-EQT 2005 takeover of ISS, which saw bondholders lose 22%pts on their debt as it became clear they could be subordinated in a higher leverage structure.

- Sterling bonds included some protection in 2000, with Segro being one of the first to include a clause preventing dividends out of pre-acquisition profits. Sainsbury followed in 2001 agreeing to covenants agreeing to repay bondholders if there was an Event Risk, including an acquisition, that led to a downgrade below investment grade – which became the standard approach.

- I was advising BAA in 2006 when it received a takeover approach from Ferrovial which landed between pricing and settling a bond (technically the banks had underwritten settlement risk). The bond had no takeover protection and so investors demanded changes to protect them, with some threatening to walk – which could have led to difficulties for the underwriting banks. After some frantic negotiations with bondholders and the Takeover Panel, BAA inserted standard CoC protection (which was triggered very quickly). Some people regarded this as a “poison pill” but it’s more likely that Ferrovial realised there could be a buyer’s strike if it didn’t agree.

- Diageo remains one of the few issuers to refuse to include CoC provisions – almost as a matter of pride.

- Finally, this is a great write-up of the dangers of not analysing the terms of target debt: when Mike Ashley bought Newcastle United, his team spent just 3 days on DD and didn’t notice that the US Private Placement bondholders had exceptional Change of Control Protection: not just par, but they were also due a 10% makewhole. Ultimately this all cost Mike Ashley another £30m but as he said, “I just thought: ‘Shut up about it.’ I’m a big boy and I didn’t cry”.

3. Bank logos

- As I went past Wells Fargo’s new office on London Bridge, I saw its stagecoach in the lobby and it got me thinking about bank logos. Sticking just to the UK banks this week:

- Barclays’ eagle is apparently linked to Odin and strength / valour etc and dates from its 1690 office on Lombard Street. When Barclays was bidding for ABN Amro in 2007 , some suggested it should drop the logo because of its association with Nazi symbolism. In the end, Barclays lost out to ABN and the logo remains today.

- NatWest’s logo symbolises the 1968 three-way merger of National Provincial, Westminster, and District Bank. While our new office is lovely, it’s not designed around our logo like Tower 42.

- Lloyds’ Black Horse logo dates back to 1894. It turns out there is a real horse behind the logo – most recent is Holme Grove Prokofiev. And here is a bizarre story that I had missed in 2018 where Noel Edmunds tried to get Lloyds’ TV ads banned, because of the way HBoS Recovery Team handled impaired businesses.

- HSBC’s logo is much more recent, dating back to 1983 and first seen in the UK in 1989 following the acquisition of Midland (your regular reminder that Saatchi & Saatchi bid for Midland Bank in 1987 – the world was a different place back then). I’ve just learnt today that the logo is based on the company flag, which itself was based on an hourglass and the Scottish St Andrew’s flag.

- Finally (for now) Santander, with its red flame that according to Santander itself (in a fiery Latin way): “represents the element of fire, evoking the role it has played in human evolution and prosperity: an ally that has helped us evolve and advance as a species.”

- And Numis? As displayed in our annual report, the circle reflects our name’s origin in 2000, being derived from the ancient Greek for coin.

UK Financings this week

- 888 has put together a £2.1bn loan to back its acquisition of William Hill’s non-US businesses, via JP Morgan, Morgan Stanley and Mediobanca. Expect to see this in the leveraged loan market soon.

- Unite signed its first Sustainability Linked Loan, a £450m RCF with HSBC, NatWest and RBC (margin will move +/- 2.5bp).

- EasyJet has agreed a new RCF of $400m alongside its recapitalisation. Maybe not coincidentally, two of the bookrunners on the rights issue include Santander and SocGen.

- Insurance management services business Charles Taylor has agreed a £425m facility with Ares.

- Life sciences investor BioPharma Credit has extended its RCF with JPM to 2024 but has reduced it from $200m to $50m, with pricing falling from 400bp to 275bp.

- Smart Metering Systems agreed a 4-year £420m RCF with Barclays, HSBC, NatWest, Lloyds, Clydesdale and Bank of Ireland, which increases its previous £300m RCF.

- Harworth (land and property regeneration) extended its RCF by 2 years and upsized by £20m to £150m, through NatWest and Santander.

- CityFibre added £300m to its loan portfolio with Credit Ag, National Australia Bank, ABN, IMI, BNP Paribas, Lloyds, NatWest and SocGen.

- Kier downsized its RCF from £675m to £475m after its recap, and extended the maturity to January 2025 (just under 3.5 years). Margins have gone up by c. 100bp, to Sonia+285bp.

- In bonds: BP issued €750m 20-year Euro bonds at ms+105bp, Segro placed €500m of green bonds at ms+55bp; and UK Power Networks issued £300m 13-year Gren Bond at G+88bp, a 2bp discount to its brown bonds.

Our services

Numis is an ambitious, dynamic and innovative investment bank, driven to excel across all aspects of its delivery.