-

BackWhat we doNumis is an ambitious, dynamic and innovative investment bank, driven to excel across all aspects of its delivery.Investment Banking

-

BackLatest newsRead the latest news about our business, our people and our work, find out about our next events and conferences.News

-

BackWho we areOur collaborative environment and distinctive way of excelling , is nothing without our great people.

-

BackOur board

Debt Advisory Update

It’s exactly one year since Dominic Cummings sat down at that rather small table in the No 10 Rose Garden to confess to his poor eyesight; he appears to have decided to celebrate the anniversary by demonstrating his excellent hindsight to MPs this week.

TL / DR: Too many risk-free rates; Convertibles in the rain; Amigo – no longer BFF

1. LieBore

- Libor has a surprising history: invented by the Greek banker Minos Zombanakis in 1969 for an $80m loan for the Iranian Shah and provided by banks dodging US taxes and regulations. Like Victor Frankenstein, Zombanakis fell out with his invention, calling banking “a prostitution racket run by pimps”.

- The whole point of Libor was to enable banks to lend on a “cost plus” basis, with Libor being the varying cost to obtain their own funds; with the quid pro quo that borrowers could usually prepay for free. Lots of direct lenders and institutions provide fixed rate funding but they usually need some compensation for early prepayment.

- All new £ loans are now SONIA based and increasingly $Libor is also being replaced by SOFR (Secured Overnight Financing Rate). Euribor is likely to be with us for a little longer.

- Banks are now asking borrowers to reopen existing loans to change Libor to new Risk Free Rates:

- It’s not often banks need something from their borrowers. Tempting as it might be to ask for something in return, it may be better to ‘bank’ the favour for later.

- The Bank of England is clear on its choice of SONIA, compounded over the interest period in question and in future maybe using SONIA futures contracts.

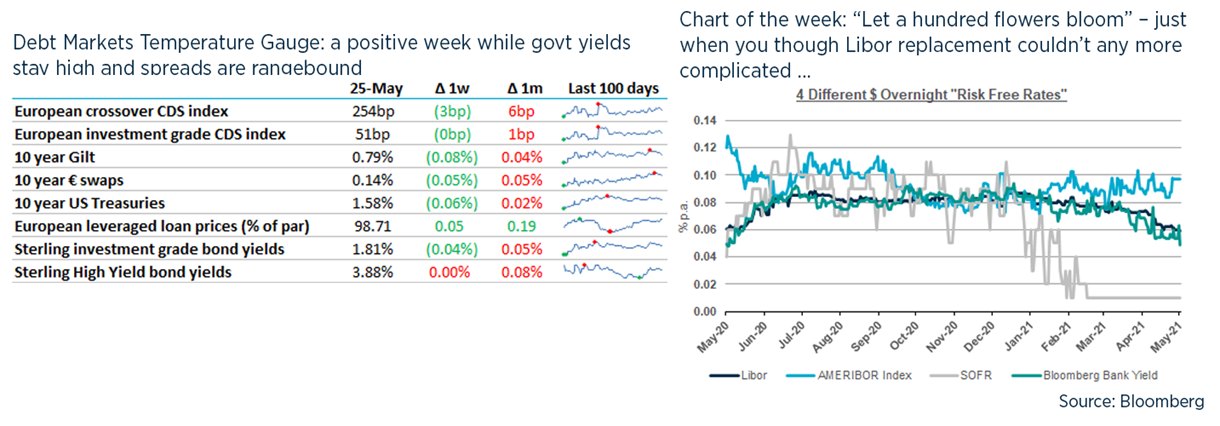

- However, true to its pluralist founding, the US is adopting the Maoist principle of letting a hundred flowers bloom: while the Fed prefers SOFR, enterprising data providers have created new indices that deal with the differences between SOFR and Libor: (1) SOFR is an overnight rate rather than a forward-looking term rate and (2) SOFR is secured i.e. collateralised borrowing where banks provide US treasuries as collateral to their lenders.

- The two leading alternatives are Ameribor and Bloomberg Short-Term Bank Yield (BSBY). These are not simple: BSBY takes 36 pages to explain how it analyses bank deposits and bond trades to produce a forward curve, while Ameribor makes use of the astounding number of US banks to produce another overnight rate, which then needs more futures contracts to generate a forward curve.

- Duluth Holdings became the first company to borrow using BSBY last week, though I really don’t understand why it bothered to break this new ground.

- Not surprisingly, the regulators don’t like these alternatives – suggesting they are effectively made-up in a similar but different way to the original problems with Libor.

- For our clients, the consensus among UK and European banks is clearly for SOFR.

2. Convertibles aren’t so good when it rains

- I’ve written before about convertibles including Trainline’s recent deal which went so well in January: £150m of 5 year money at 1% coupon with a 50% conversion premium.

- Unfortunately, the Williams’ review released last week was not a positive for Trainline’s business model, with its shares falling by 35% to £2.80.

- The conversion price of £6.69 therefore looks a reach, requiring the share price to increase by 20% p.a. for the rest of the life of the bond – otherwise the bond is repayable at par.

- Trainline’s convertible is now trading as a straight high yield bond – the price has fallen from around par to 80 and the bid yield to maturity is now almost 6%, which is similar to PureGym or McLaren, and better than Stonegate.

- The good news for TRN is that the cost to service the convertible remains absurdly low, it has no financial covenants and doesn’t need to be refinanced for more than 3 years.

- In the past, some convertible issuers come unstuck when their share price falls so much that refinancing is not possible in the convertible bond market.

- In the UK, the typical maximum size for a convertible is c. 10% of the market capitalisation plus the conversion premium, so normally about 13% in total. Trainline’s market cap of £1.4bn is still enough to absorb a new deal if necessary and in addition, Trainline has the ability to issue equity to the bondholders instead of repaying in cash (share settlement).

- In the past, I’ve seen Cable & Wireless struggle to refinance and Premier Oil ultimately needed to reduce its conversion price by almost 90% and hand out warrants.

3. No longer your BFF

- You need to be a very good friend to enter into a “guarantor loan” – or maybe the borrower needs to be a very bad friend. It’s also pretty hard to see why a guaranteed loan needs an APR of 49.9%. Nonetheless, Amigo made a business out of this that was at one point worth more than £1.4bn.

- The FCA got involved and found that it failed to carry out basic affordability checks – a good summary here. It ordered Amigo to pay compensation to affected customers, which climbed to over £150m and could lead to administration.

- The founder and ex-CEO has lodged some pretty trenchant criticism over the past year on Twitter – offering to come back to fix things.

- Amigo’s solution was a court-sanctioned Scheme of Arrangement that would have reduced payouts to affected customers by 90% while maintaining some equity value and director’s bonuses.

- The FCA objected saying that Amigo could do better for its customers and today the judge agreed, saying “where the purpose of the restructuring is to recapitalise a company one would normally expect to see the equity holders losing their economic interests before those of the creditors”.

- Although this seems obvious, in other recent restructurings for Virgin Active and New Look, equity holders have maintained control even as creditors like landlords have been compromised.

- In related news, the Institute of Directors and insolvency practioners have warned that the end of the bar on insolvency petitions in June could lead to a “cliff edge” that many businesses could fall over. Similarly the relaxation on wrongful trading also comes to an end in June.

UK Financings this week

- Not UK, but noteworthy anyway: Amazon raised $18.5bn of bonds with maturities of 2-40 years; given Amazon holds $34bn of cash, it’s not clear why they raised the new debt except for that it is pretty cheap money. This represented the cheapest ever 20-year corporate bond (T+70bp) and cheapest ever 2-year bond (T+10bp) which was also a sustainable Use of Proceeds bond.

- Premier Foods completed its transformation by refinancing its £175m RCF with Barclays, BNP Paribas, Lloyds, HSBC Citi and Rabobank and then pricing a 5NC2 £330m high yield bond at 3.5%, upsized from £300m. The CEO earned his profile piece in the ST this weekend – shame they didn’t have space to include the rest of the finance team too.

- Eurostar has managed to secure £50m credit facilities guaranteed by shareholders including the French state, alongside a £150m shareholder loan and additional £50m of equity to support the two daily London-Paris return trips that begin this week. I cannot wait to go back to Paris, to run along the quays and then have a glass a rosé in the Place des Vosges …

- DBAY has arranged $210m of facilities from Deutsche Bank for its acquisition of Telit.

- Looker’s refinanced existing debt into a new downsized £150m RCF (from £250m) maturing in Mar-2023 (from 2022) with its existing lenders (Bank of Ireland, HSBC, Barclays, Lloyds & NatWest).

- Ted Baker also refinanced 2022 debt replacing ~£130m of facilities into a new £80m facility out to Nov-2023 (with NatWest, Barclays, HSBC & BBVA).

- HICL Infrastructure renegotiated their £400m RCF to become sustainability linked and incorporate SONIA also out till May-2023.

- Staffline has turned to receivables financing line of £90m to refinance their existing debt for 4.5 years, alongside an equity placing.

- Euromoney has refinanced into a new £190m RCF for a further 3 years with HSBC, BAML, BNPP, Commerz and Lloyds.

- Wise (formerly Transferwise) agreed a new 3-year £160m RCF with SVB, Citi, JPM and NatWest.

- Britvic extended the maturity of its £400m sustainability linked RCF to Feb-26 with 6 out of 7 participating banks agreeing to the extension option.

- Biffa financed its acquisition of Viridor Waste Management Limited with £150m of 7-10 year private placement facilities with MetLife and Pricoa for an average cost of 2.73%. It’s unusual to see PPs used to finance acquisitions – it’s difficult to coincide the deal with the financing.

- Origin Housing placed £120m of green private placement bonds with new US investors for 15-30 years in line with the LMA principles.

- Motor Fuels Group is in the market with a dividend recap, taking out c. £330m – has required existing loans to be repriced up 25bp.

- Hammerson launched a benchmark EUR sustainability linked bond to price this week, as it tenders for c. £1bn of existing bonds.

- Card Factory completed a £225m refinancing, including £50m of CLBILS, alongside an intention to raise £70m of fresh equity (on a market cap of £240m), which got harder after shares fell by 13%.

- KKR arranged £550m loans for its acquisition of John Laing from Credit Agricole, BNP Paribas, Goldman Sachs.

- Tritax EuroBox cut 30bp off its margin after receiving a BBB- (investment grade) credit rating from Fitch.

Our services

Numis is an ambitious, dynamic and innovative investment bank, driven to excel across all aspects of its delivery.