-

BackWhat we doNumis is an ambitious, dynamic and innovative investment bank, driven to excel across all aspects of its delivery.Investment Banking

-

BackLatest newsRead the latest news about our business, our people and our work, find out about our next events and conferences.News

-

BackWho we areOur collaborative environment and distinctive way of excelling , is nothing without our great people.

-

BackOur board

Debt Advisory Update

Three more debt delights. In the week that the EU starts proceedings against the UK government, this week’s theme is law-breaking.

They can only be kicked so far; Even Rolls-Royces break down; Ground rents grounded

“I fought the law, and the law won”

- We advised many borrowers this year on getting banks to give covenant relief – helpfully the Bank of England told lenders they shouldn’t use C19 as an reason to gouge economics

- But relaxation often lasted only until Q1/ Q2: kicking the can and accepting having to deal with it next year

- Lenders tell us they can’t ignore fundamentals for ever and they have limited bandwidth for restructurings

- So what to do? Plan ahead, don’t bet the house on an expected turnaround and talk to us early

- Incidentally, I’ve been wondering: it seems to me that landlords are often really debt financiers for their tenants. If so, is the move to turnover rents akin to a debt-for-equity swap? And if so, does that mean that property-backed loans are really ‘back leverage’ against equity?

A dodgy Roller

- In 2009, I worked on the most English of financings: a Sterling bond for Rolls-Royce priced on St George’s Day. Back then RR was rated A-: it’s now rated BB, which is 5 notches lower

- The big news is the £2bn rights issue to recapitalise the business but there are eye-catching debt numbers in the press release too:

- A new £1bn high yield bond: its first as a “junk” issuer but still only c. 4-5%

- Amazingly the 2009 A- bond cost 6.75% (G+325bp) – and we were confident we’d got them a great deal!

- Another £1bn of Govt guaranteed loans (80%) (thanks Rishi)

- £1bn 2-year term loan, albeit this is only available after cancellation of the recent £1.9bn liquidity facility: the banks giveth and the banks taketh away …

- Latest news is that its lead banks (GS and MS) pulled back from the rights issue, leaving the junior banks to leapfrog their way to the front, BNP Paribas in particular

- But RR could have other financing problems

- FX: RR is a voracious user of banks’ long-dated FX hedging capacity, but this year they cancelled $10bn of long-term hedges at a cost of £1.5bn. Although prompted by less future US$ receipts, it would also have helped banks by reducing their credit exposure for out of the money hedges

- Engine financing: Rolls has for many years sold & leased back its engines, parking them off-balance sheet and using the private placement market to finance these. Unless RR’s credit rating improves then these engines may now come back under RR’s wing

Gone to ground

- I’ve often been pitched ground rent deals over the past few years: a sale & leaseback of operating property

- This is a low enough rent that (a) the lessor can believe the rent is without any credit risk and simply an inflation-linked cashflow and (b) the (now) leaseholder is able to present the long-leasehold as pretty much the same as before, hoping to leverage the remaining EBITDA with his ‘senior’ lenders

- Not all lenders liked this, as NatWest complain here, but enough were willing to ignore it for some private equity investors to extract all equity from a deal

- Of course, this is simply just more leverage, defined as extracting proceeds in return for a fixed cost (as Fitch notes here)

- These transactions were particularly popular for hotels in 2017-19 – it will be interesting to see if these pension funds and REITs end up running travelodges

- Good article here from Aviva, which definitely has some skin in the game as both an equity investor, lender and ground rent lessor

UK debt financings this week:

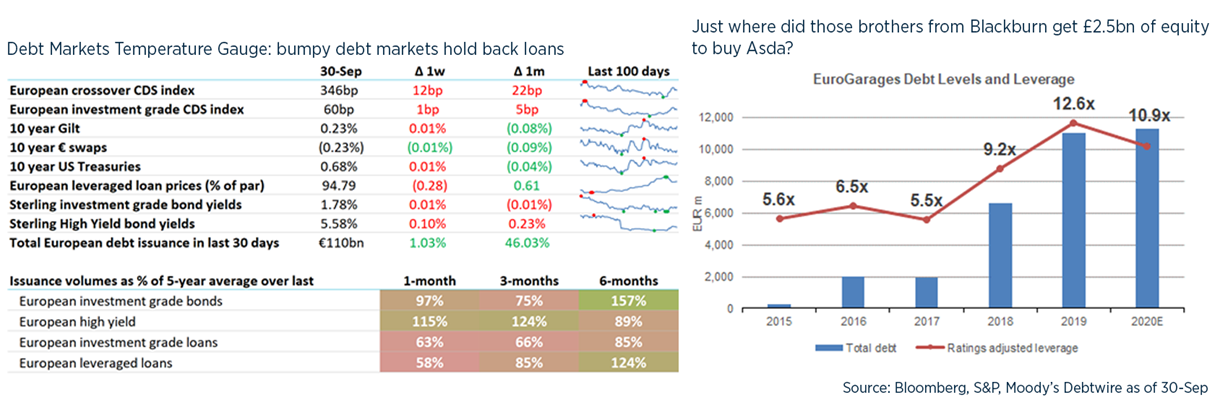

- Ceasar’s raised $2bn of debt alongside equity to buy William Hill, Innova raised a £30m loan with NatWest based on SONIA, PRS REIT added £50m to its RCF with Barclays, Garda World secured >$5bn for its hostile bid for G4S, and a bunch of banks are underwriting £4bn for the TDR / Issa Brothers bid for Asda. And of course the Rolls-Royce package above, provided by BNPP, Citi and HSBC

- Covenant waivers from Menzies, Premier Oil

Our services

Numis is an ambitious, dynamic and innovative investment bank, driven to excel across all aspects of its delivery.