-

BackWhat we doNumis is an ambitious, dynamic and innovative investment bank, driven to excel across all aspects of its delivery.Investment Banking

-

BackLatest newsRead the latest news about our business, our people and our work, find out about our next events and conferences.News

-

BackWho we areOur collaborative environment and distinctive way of excelling , is nothing without our great people.

-

BackOur board

Debt Advisory Update

This was going to be the last of the year, but I think I might have more free time than usual this Christmas so let’s see.

If not then I wish you all a good Christmas and here’s hoping that “2021 > 2020” is more than just maths.

TL / DR: Ever Closer Union; Under the (balance) sheets; A little bit of privacy

1. Ever Closer Union

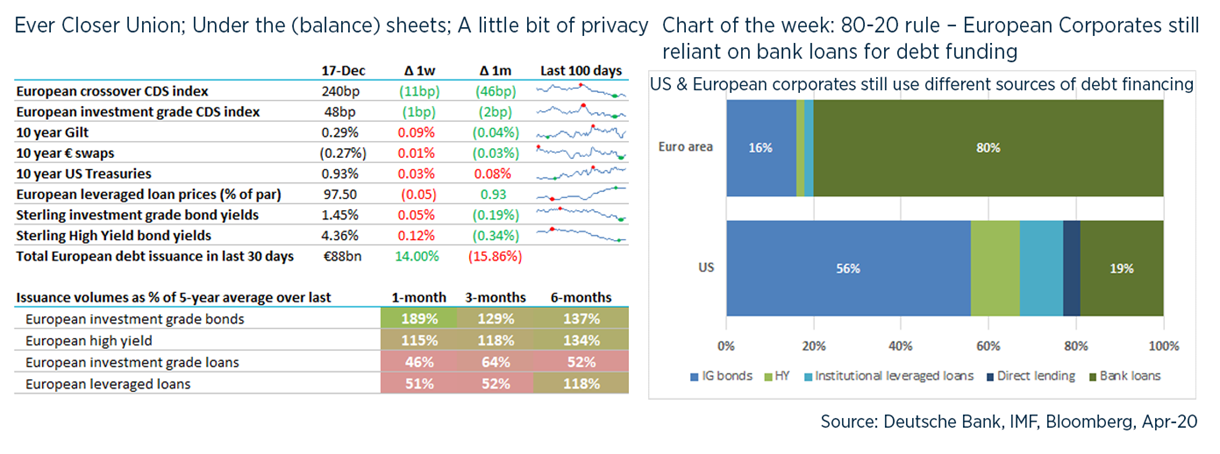

- The chart above dates from April 2020 but a similar one could have been put together 10, 20 or even 30 years ago: despite everything, 80% of debt from European corporates still comes from banks vs 20% in the US.

- As Brexit stumbles across the finish line like an exhausted marathon runner, perhaps appropriately the Europeans are getting an ever closer union for Capital Markets – perhaps presumptively, this summer the EU issued a “final report” with just 17 more actions.

- These actions include “harmonisation of corporate insolvency laws” and “introduce financial competence” so they might not be finished overnight.

- Europe has a long way to go to match the US set-up: a single federal rulebook with the SEC, common language, strong disclosure regime for security issuers and a deep pool of savings fostered by a lack of state pensions (your 401k pot might not be big enough but may be better than unfunded public pensions).

- Big question for UK corporates is whether Brexit will limit access to debt. My guess is that there will be some short-term disruption, as banks and institutions adapt, but longer-term the UK needs foreign lenders and debt investors which will drive the adoption of rules that enable this.

2. Under the (balance) sheets

- I thought I’d update our list of commonly-seen (or hidden) off-balance sheet liabilities.

- Operating leases now visible due to IFRS16 – but has this made much difference? This time last year, IFRS16 / covenants was supposed to be sorted out in 2020 but somehow we all got distracted. This has also been the year when fixed obligations like leases really became a problem, with £4.5bn of commercial property rent unpaid.

- Pension deficits – in aggregate deficits total £190bn, (nice PwC analysis here). We’ve seen some clients (such as Mothercare) defer contributions but in general these repair contributions are only going up (a retrospective pay rise?).

- Earn-outs / deferred consideration – we could do with more of these, and more M&A generally!

- Factoring – at least this involves a true-sale of assets to raise finance, unlike …

- Supply chain finance – we discussed this a couple of weeks ago.

- Derivatives: not just the MTM liability (which is usually at least disclosed) but the potential for this to move significantly further out of the money – banks regard this as a potential future credit exposure so corporates should regard it as a potential liability. For example, Marston’s swap MTM liability has increased by £60m in the past 2 years (though some of that was due to a nice piece of ‘borrowing’ by Marston’s, critiqued by Fitch here).

- Onerous leases / contracts.

- Litigation – e.g. Reckitt Benckiser’s opioid substitute.

- Guarantees of other parties’ debt (looking at you NMC). Sometimes it’s an indemnity that comes back to bite you – Cable & Wireless being the best example 20 years ago.

- Let me know anything we’ve missed. Not all of these are ‘debt’ but they should all be part of credit analysis and it’s best to be ready to answer lenders’ questions on them.

3. A little bit of privacy

- Generally, having listed equity is viewed as a credit positive by lenders: greater access to fresh equity, better governance / scrutiny, better disclosure.

- In addition, equity prices are relatively liquid / transparent compared to debt and can be used to derive the probability of default as proven by KMV (explanation here). Lots of banks use this as an input into their analysis.

- So it is interesting to see Altice finalise a deal this week to be taken private by its founder.

- Altice is not a big name in the UK but is one of Europe’s largest leveraged debt issuers, with €30bn of HY and leveraged loans. When at Barclays, I helped it issue €50bn of HY in 4 years for its European and US businesses.

- The rationale for the take-private includes a list of problems that public equity has caused (see here, page 2) and is worth a look, mostly because I think they are nearly all wrong.

- Fundamentally, I think the real reason is that public equity markets were not making the founder even richer quickly enough and he can buy back his business on the cheap.

- But it is definitely true that private investors tolerate higher leverage more than public markets, which is a little illogical given the credit positives from being listed mentioned above.

- And, despite the shock to the system, leveraged debt availability has continued to increase in 2020, whether private credit, lev loans or HY – so I think the “de-equitisation” trade will pick up again in 2021.

UK debt financings this week: Relatively quiet as lenders wind down for Christmas

- AstraZeneca arranged a $17.5bn bridge loan for its $39bn acquisition of Alexion Pharma, from Morgan Stanley, JP Morgan and Goldman Sachs, 12+6+6m.

- Virgin Media finalised a £1.5bn term loan for its merger with O2 at L+275bp with 29 banks (can you name 29 banks??).

- Stenprop arranged £66.5m 7-year fixed rate loan from ReAssure (part of Phoenix) at G+130bp (1.66%).

Our services

Numis is an ambitious, dynamic and innovative investment bank, driven to excel across all aspects of its delivery.